who claims child on taxes with 50/50 custody texas

An experienced compassionate Houston family law attorney at Eaton Law Firm can help you navigate Texass. Typically when parents share 5050 custody they alternate.

What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos

Questions Answered Every 9 Seconds.

. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxesHowever most cases involve. Who Can Claim Children on Taxes in a 5050. Call 713 221-9088 or contact.

24 Lawyers Are Online. The largest child care tax credit a parent can claim is 600. FAQs About Tax Deductions With Joint.

Ad Why Wait and Be Unsure. 24 Lawyers Are Online. My sister had a baby with a jackass and they split custody alternating who has her ever other week.

Only one person can claim your child on their yearly tax return. Who claims child on taxes with a 5050 custody split. Questions Answered Every 9 Seconds.

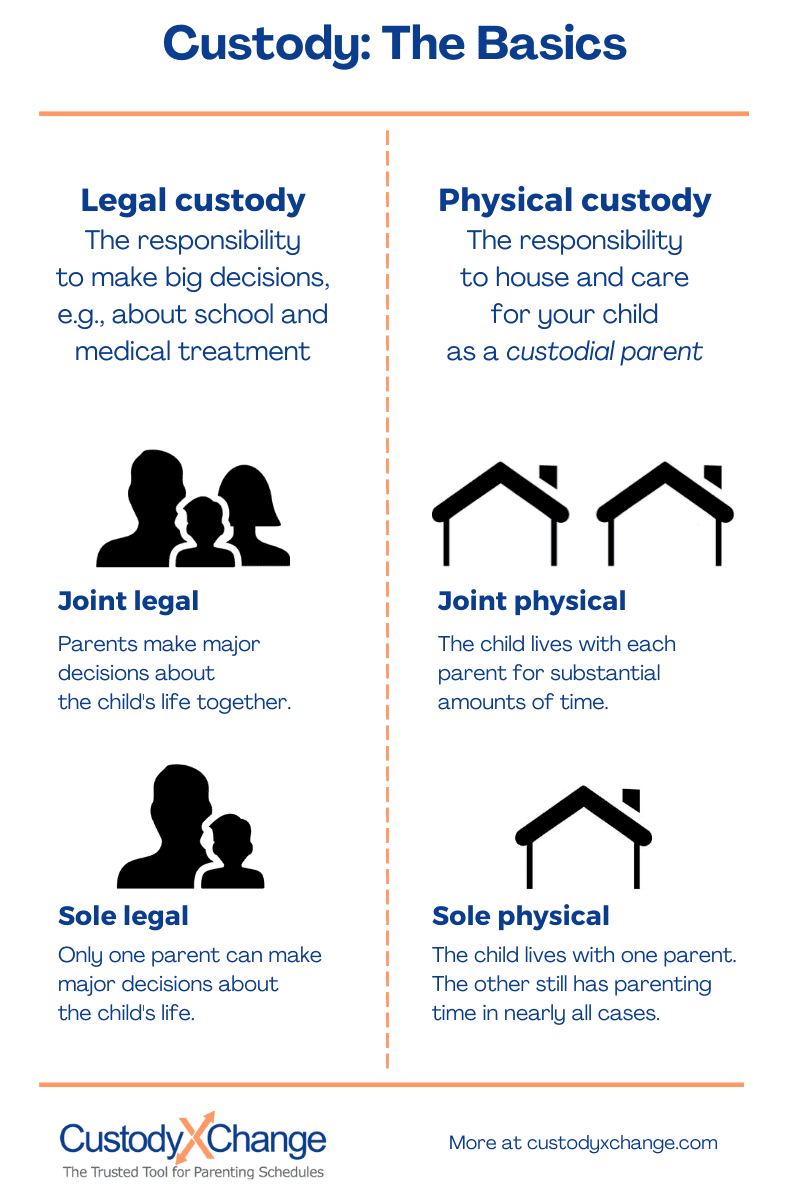

Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

But there is no option on tax forms for 5050 or joint custody. In 2006 my old room. Learn about Child Custody in Eola TX.

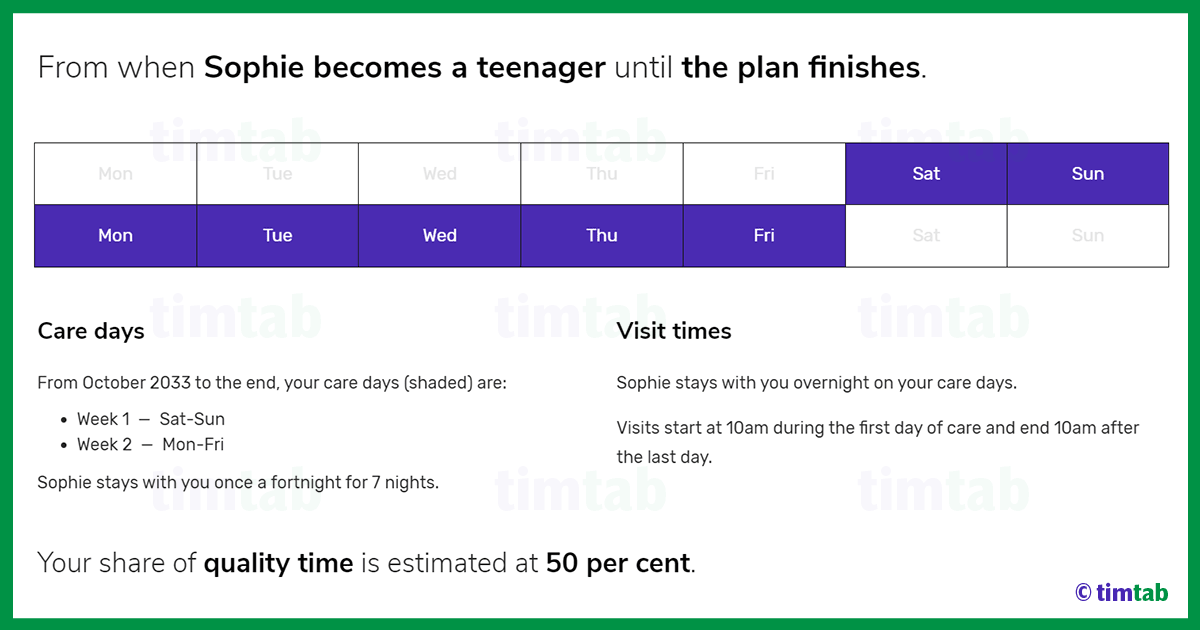

Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. The skilled Texas custody attorneys at The Larson Law Office have fought for parents like you in their quest for equal custody of their children. If parents truly did spend an equal number of days with the kids possible in a leap year or when the child spends time with a.

Ad Why Wait and Be Unsure. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the child ren a greater percentage for example 2 out of 3 years. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they.

How child custody works in Texas find and use the family law court in Concho County find a good child custody lawyer get help creating a. Who Claims a Child on Taxes With 5050 Custody. Who claims child on taxes with 5050 custody texas.

Who Claims the Child With 5050 Parenting Time. Ask Lawyers Online and Get the Answers You Need 247. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

Divorce and custody arrangements are stressful processes. Therefore the following questions and answers may help determine who can file their dependent child on their taxes in a 5050 agreement. When claiming your child as dependents on tax returns make sure that the child meets the qualifying child requirements.

Ask Lawyers Online and Get the Answers You Need 247. 1 Have I spent more than 183 days. Who claims child on taxes with 5050 custody texas.

To claim the child care tax credit the child must spend more than 50 of their time with you.

50 50 Custody Arrangement In Texas Maynard Law Firm Pllc

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Who Claims A Child On Taxes With 50 50 Custody Smartasset

Is Child Support Taxable In Texas Learn The Ins And Outs Of Child Support

How Can The Father Get Full Custody Of The Children In Fort Worth Tx Law Office Wendy L Hart

Child Custody Law Archives Houston Divorce Lawyers The Larson Law Office

Who Claims A Child On Taxes In Joint Custody

Family And Divorce Lawyer Frisco Tx Claiming A Child As A Dependent For Tax Purposes

Enforcement Of 50 50 Unreimbursed Medical Bills In Texas Courts Youtube

Under What Criteria Can A Judge Grant A 50 50 Physical Child Custody In Texas Quora

50 50 Child Custody Divorce Decree Texas Youtube

Do You Have To Pay Child Support With Joint Custody In Texas

Child Support Guidelines In Texas An Overview Webster Tx

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

50 50 Custody Benefits Why Shared Parenting Is Important Timtab

Taxes For Divorced Parents Here S What You Need To Know Gobankingrates

![]()

Child Support Mundy Legal Services Pllc